Public Pension

Table of Contents

Plan Description

The City of Waco participates as one of over 900 plans administered by the Texas Municipal Retirement System (TMRS). TMRS is a statewide public retirement plan created by the State of Texas and administered in accordance with the Texas Government Code, Title 8, Subtitle G (TMRS Act) as an agent multiple-employer retirement system for employees of Texas participating cities. The TMRS Act places the general administration and management of the System with a six-member, Governor-appointed Board of Trustees; however, TMRS does not receive any funding from the State of Texas. TMRS issues a publicly available annual comprehensive financial report (ACFR) that can be obtained at www.tmrs.com.

Benefits Provided

The City of Waco has chosen from a menu of plan options as authorized by the TMRS statute. The City of Waco’s plan provides the following benefit level:

| Employee Contributions |

7% of Pay |

| City to Employee Matching Ratio |

2 to 1 |

| Updated Service Credit Rate |

100% repeating transfers |

| Cost of Living Adjustments |

Effective 1/1/24 the City implemented a 30% non-retroactive repeating Cost of Living Adjustment. |

| Years Required for Vesting |

5 Years |

| Service Retirement Eligibility |

5 Years age 60 or 20years any age |

| Supplemental Death Benefit to Active Employees |

No |

| Supplemental Death Benefit to Retirees |

No |

All eligible employees of the City are required to participate in TMRS. Upon retirement, the employee account balance including interest is combined with the employer match to price a lifetime annuity based on the employee’s age at retirement.

Employees Covered by Benefit Terms

At the December 31, 2024 valuation and measurement date, the following employees were covered by the benefit terms:

| Inactive employees or beneficiaries currently receiving benefits (Annuitants) |

1,264 |

| Inactive employees entitle to but not yet receiving benefits |

859 |

| Active employees |

1,611 |

| Total |

3,734 |

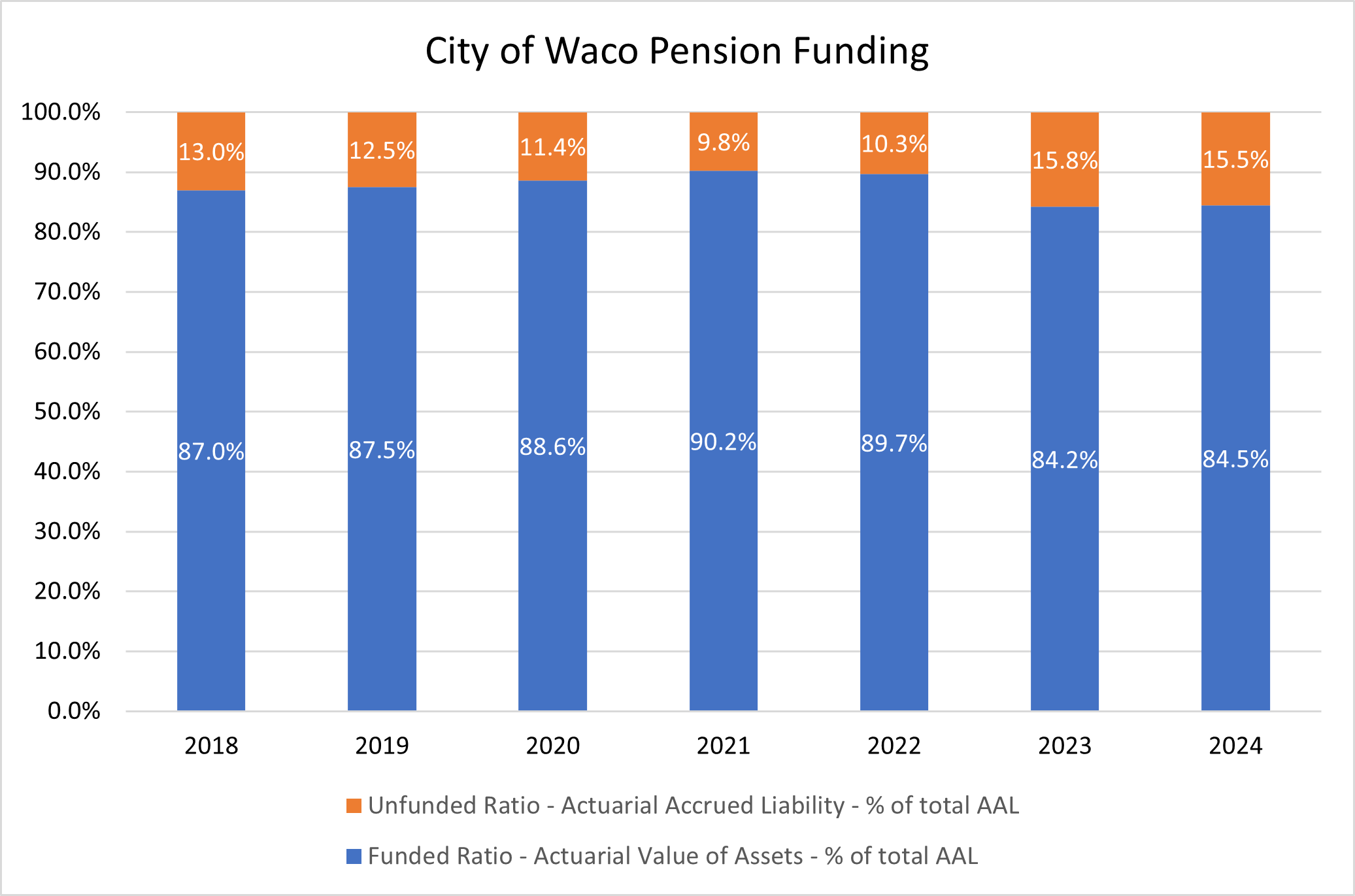

Pension Summary

TMRS provides each of its member cities with two slightly different actuarial valuations which are both reflected below as of December 31, 2024 (TMRS’ year-end is December 31, 2024, and that is the most recent valuation date for which data is available and has been provided to the City). The first is a funding valuation which uses a smoothed actuarial value of assets to calculate the City of Waco’s actuarially determined contribution (ADC) to the plan. The second valuation is provided for Governmental Accounting Standards Board (GASB) Pronouncement 68 financial reporting purposes and reflects the City of Waco’s fiduciary net position based on the market value of its assets on the reporting date. Results of the most recent valuation follows:

| Equivalent Single Amortization Period |

13.1 |

| Annual Payroll |

$125,148,164 |

12/31/2024

| Actuarial Funding Validation |

Amount |

| Actuarial Accrued Liability (AAL) |

$710,582,556 |

| Actuarial Value of Assets (AVA) |

$600,218,414 |

| Unfunded Actuarial Accrued Liability (UAAL) |

$110,364,142 |

| Funded Ratio |

84.5% |

| UAAL as a percentage of covered payroll |

88.2% |

12/31/2023

| GASB 68 Valuation |

Amount |

| Total Pension Liability |

$670,319,008 |

| Plan Fiduciary Net Position |

$562,142,652 |

| Net Pension Liability (NPL) |

$108,176,356 |

| Funded Ratio |

83.9% |

| NPL as a percentage of covered payroll |

90.8% |

Using both valuation methods, the City’s funded ratio is above 80%. It is important to note that the primary financial objective of TMRS is to achieve the long-term full funding of promised benefits and each calendar year, TMRS informs the City of what its contribution requirements are to achieve this financial objective.

Downloadable Data(XLSX, 18KB)

Contributions

Employees are required to contribute 7% of their annual gross earnings based on the City’s plan provisions.

Actuarially Determined Contributions

(as a percentage of pay)

| Calendar Year |

2022 |

2023 |

2024 |

2025 |

2026 |

| Employee Rate |

7.00% |

7.00% |

7.00% |

7.00% |

7.00% |

| City Rate |

14.34% |

13.67% |

13.92% |

18.04% |

18.13% |

| Total Actuarially Determined Contributions |

21.34% |

20.67% |

20.92% |

25.04% |

25.13% |

Investments

More detailed information regarding investment objectives, policies, and performance of the TMRS pension system can be found at https://www.tmrs.org/investments.php or in the TMRS Annual Financial Report. TMRS’ current assumed rate of return and total fund return at 1 year, 3 years, 5 years, and 10 years, follow:

2024 Investment Results

(TMRS Total Fund Return)

| 1 Year |

5 Years |

10 Years |

| 10.41% |

6.82% |

6.62% |

Source: TMRS 2024 Annual Comprehensive Financial Report

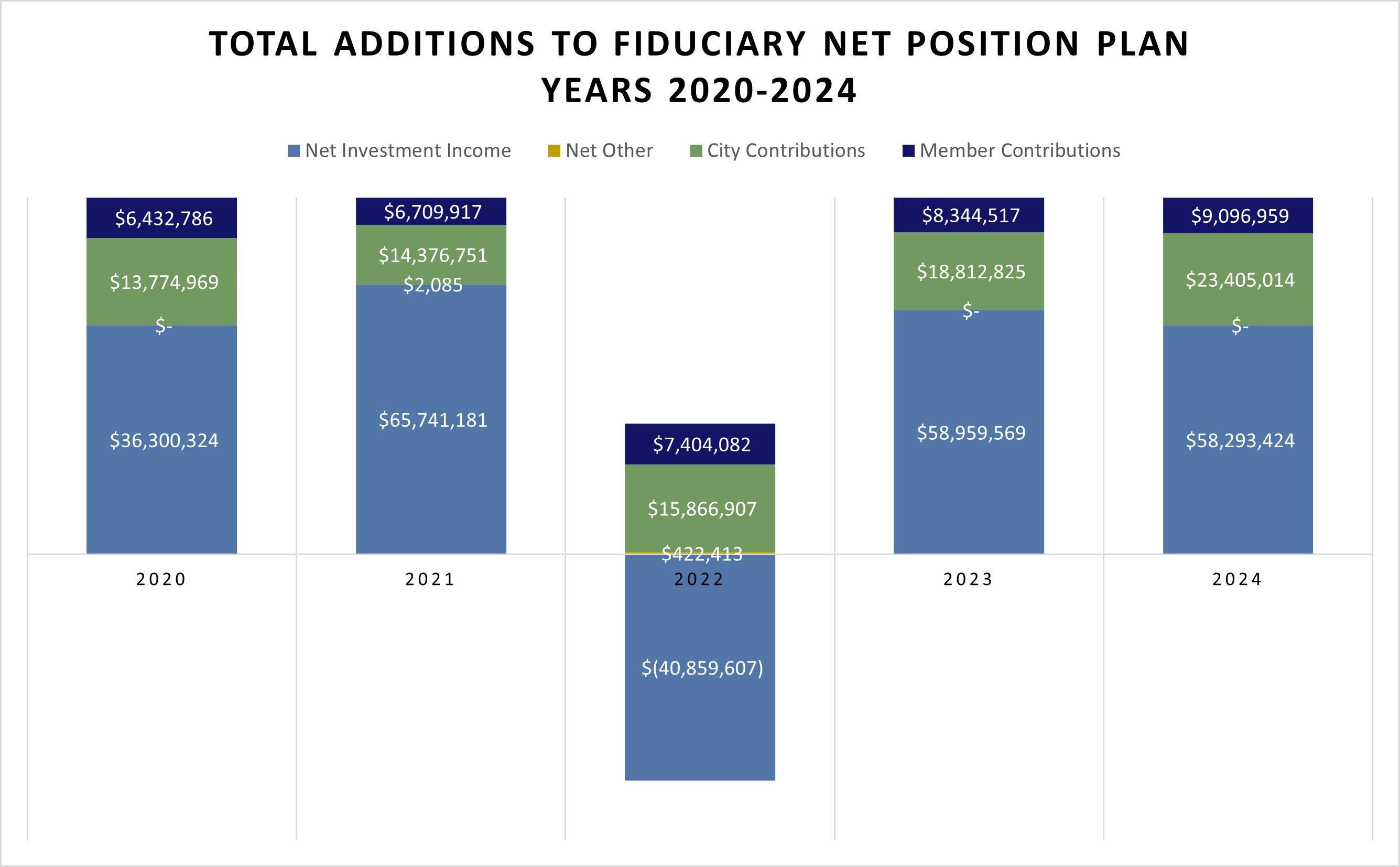

Changes in Fiduciary Net Position

The fiduciary net position is the market value of the assets of the trust. For GASB 68 reporting purposes, the City of Waco’s total pension liability is reduced by the fiduciary net position to arrive at the City’s net pension liability. The breakout of the additions to and deductions from the City’s fiduciary net position for the most recent valuation period as of 12/31/2024 follows:

Downloadable Data(XLSX, 26KB)

Reference Documents & Schedules

Actuarial Valuations (Funding Valuation) - City of Waco Specific

GASB 68 Valuation - City of Waco Specific

Statement of Changes in Fiduciary Net Position

Archived Schedules

- (PDF, 1MB)

- (PDF, 1MB)2023 Schedule of Changes in Fiduciary Net Position(PDF, 2MB)

- (PDF, 2MB)

- (PDF, 2MB)2022 Schedule of Changes in Fiduciary Net Position(PDF, 1MB)

- 2021 Schedule of Changes in Fiduciary Net Position(PDF, 785KB)

- 2020 Schedule of Changes in Fiduciary Net Position(PDF, 2MB)

- 2019 Schedule of Changes in Fiduciary Net Position(PDF, 4MB)

- 2018 Schedule of Changes in Fiduciary Net Position(PDF, 1MB)

Links to Other Information